If you end up with a bigger credit than you have income tax due a 3 000 credit on a 2 500 tax bill for instance you can t use the credit to get money back from the irs.

Irs 2018 solar panel credit.

Irs gov latestforms to make sure you have the latest version of forms instructions and publications.

And 300 for any item of energy efficient building property.

A total combined credit limit of 500 for all tax years after 2005.

The federal itc makes solar more affordable for homeowners and businesses by granting a dollar for dollar tax deduction equal to 26 of the total cost of a solar energy system.

A credit limit for residential energy property costs for 2018 of 50 for any advanced main air circulating fan.

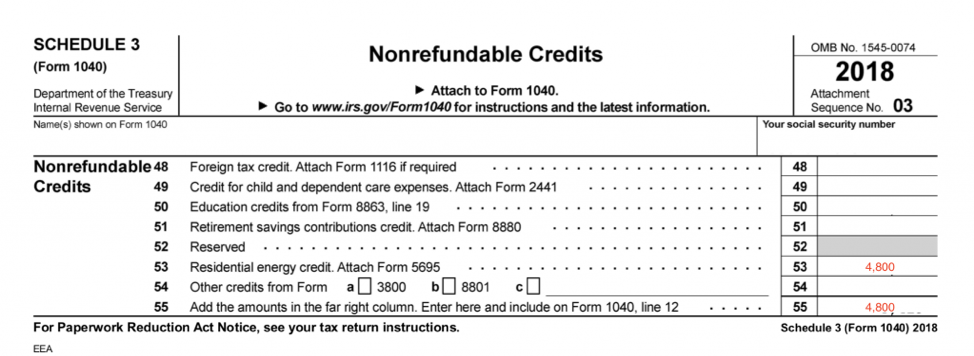

You calculate the credit on the form and then enter the result on your 1040.

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

The taxpayer certainty and disaster tax relief act of 2019 has made the nonbusiness energy property credit available for 2018 and 2019.

Nonbusiness energy property credit is available for 2018 and 2019.

An average sized residential solar.

Step 2 figure out how much your.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

Once you get to line 53 it s time to switch over to form 5695.

Step 1 start with the 1040.

To claim the credit you must file irs form 5695 as part of your tax return.

150 for any qualified natural gas propane or oil furnace or hot water boiler.

The residential renewable energy tax credit as the irs calls it can be an attractive way to save on the significant cost of installing solar panels or roofing.

A combined credit limit of 200 for windows for all tax years after 2005.

If you re considering solar you ve probably heard about the federal solar tax credit also known as the investment tax credit itc.

All references to the credit have.