For vehicles acquired after december 31 2009 the credit is equal to 2 500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417 plus an additional 417 for each kilowatt hour of.

Irs energy efficient tax credit 2017.

Equipment tax credits for primary residences.

The non business energy property tax credits have been retroactively extended from 12 31 2017 through 12 31 2020.

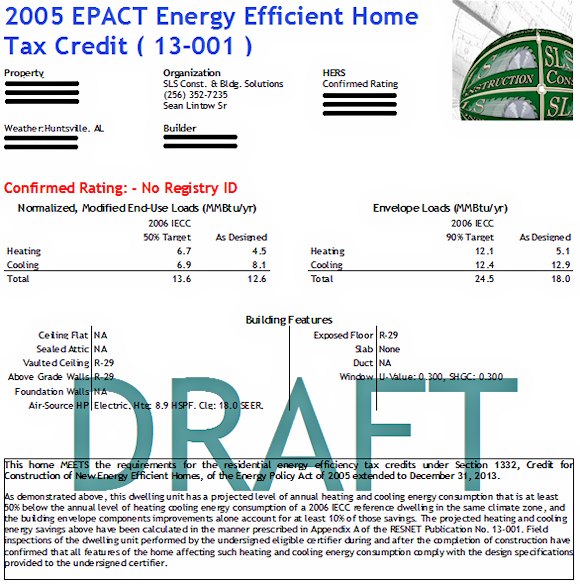

Form 8908 is used by eligible contractors to claim a credit for each qualified energy efficient home sold or leased to another person for use as a residence.

Here are some key facts to know about home energy tax credits.

Who can take the credits you may be able to take the credits if you made energy saving improvements to your home located in the united states in 2018.

Taxpayers who made certain energy efficient improvements to their home last year may qualify for a tax credit this year.

Information about form 8908 energy efficient home credit including recent updates related forms and instructions on how to file.

You may claim these credits on your 2017 tax return if you.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

Federal income tax credits and other incentives for energy efficiency.

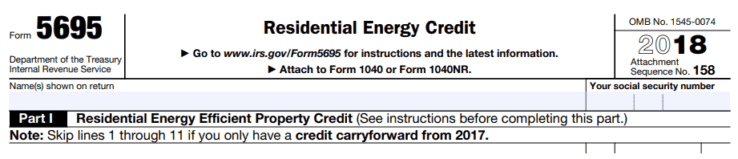

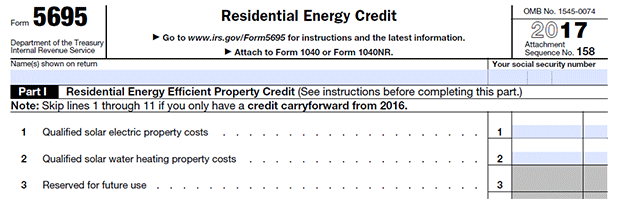

Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file.

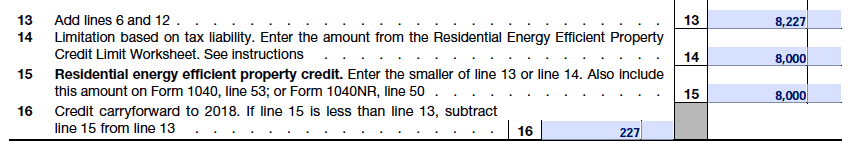

Also use form 5695 to take any residential energy efficient property credit carryforward from 2017 or to carry the unused portion of the credit to 2019.

The bba reinstated the nonbusiness energy property credit for 2017 and it reinstated the residential energy efficient property credit for qualified small wind energy property costs qualified geothermal heat pump property costs and qualified fuel cell property costs to the end of 2021.

Taxpayers who upgrade their homes to make use of renewable energy may be eligible for a tax credit to offset some of the costs.

The residential energy credits are.

10 of cost up to 500 or a specific amount from 50 300.

Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

Must be an existing home your principal residence.

Non business energy property credit.

Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020.

The renewable energy tax credits are good through 2019 and then are reduced each year through the end of 2021.

The consolidated appropriations act 2018 extended the credit through december 2017.

The nonbusiness energy property credit expired on december 31 2017 but was retroactively extended for tax years 2018 and 2019 on december 20 2019 as part of the further consolidated appropriations act.

December 31 2020 details.

Claim the credits by filing form 5695 with your tax return.